Observing the daily movements from open to close can give you a nice impression on intraday support & resistance and possible break out points. Therefore you can use the day range indicator for trend trading (breakouts) and intraday targets (support/resistance). The basic version is pre-defined in the tradesignal terminal software.

I added a volatility band around this indicator to make it more useful for trading.

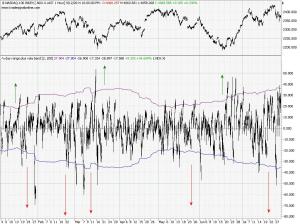

The first screenshot shows you what this indicator is all about: it basically just displays the daily movement starting at zero. Thus the indicator only displays the intraday movement, without any information on the absolute level of the market or the longer term trend. The band around the indicator is a 2 standard deviation band over the last 200 candles (customize on properties page of indicator)

There are 3 possible scenarios you might use this indicator for; see screenshot for details:

A (and B): This is the normal scenario, on a normal day when nothing special happens. The market usually will touch the band (B) or penetrate it a little bit and then come back (A). Thus this indicator can be used to get an estimation for some kind of intraday profit target.

C: That`s one of the days when this indicator gives the best signals. A Crazy Day! If the market does not reverse around the band (A&B) you can bet on a nice movement until the closing bell. Have a look at screenshot 2 to get a glimpse on what can happen on such days:

The touch of the band is also an interesting point for option strategies. In this case the upper and lower bands represent some kind of action point where you might want to revisit your hedging of the position…

The indicator code:

Inputs: dev(2.0),period(200);

Variables:oo( Invalid ),colour;

colour=black;

If Date Date[1] Then oo = Open;

drawline(0+dev*stdev(Close - oo,period));

drawline(0-dev*stdev(Close - oo,period));

if close-oo>dev*stdev(Close - oo,period) then colour=darkgreen;

if close-oo<-1*dev*stdev(Close - oo,period) then colour=red;

DrawBar( Open - oo, High - oo, Low - oo, Close - oo,colour,colour);

Drawline( 0, "Zero Line" );