Clustering of signals can lead to some nice high probability trades.

clustering: when signals on different timeframes show the same; thus all traders, regardless if they trade daily or intraday, have got the same setup on their charts.

To make use of clustering signals you must have a multiple timeframe indicator that shows you what the traders on different timeframes can see right now.

Therefore I added a second timeframe to the Bollinger band. This multiple timeframe indicator wills how you the daily and weekly Bollinger band, even when applied on an intraday chart!

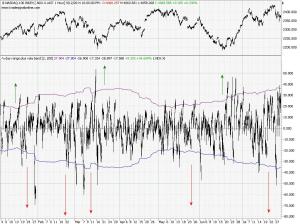

daily chart showing daily and weekly Bollinger. note the clustering when daily and weekly Bollinger bands overlap:

hourly chart showing daily and weekly Bollinger:

indicator code:

Meta:SubChart( False );

Inputs: Period( 20 ), StdDevs( 2.0 );

Variables:

avg, lowerBand, upperBand,avg2, lowerBand2, upperBand2;

BollingerBands( close of 'data1 d', Period, StdDevs, avg, upperBand, lowerBand );

BollingerBands( close of 'data1 w', Period, StdDevs, avg2, upperBand2, lowerBand2 );

DrawLine( avg, "Mid Line D", StyleDot );

DrawArea( upperBand, lowerBand, "Upper Band D", "Lower Band D" );

DrawLine( avg2, "Mid Line W", StyleDot );

DrawArea( upperBand2, lowerBand2, "Upper Band W", "Lower Band W" );